The GrowSF Report: Silicon Valley Bank collapses

PLUS: Supervisor Connie Chan fought police funding, it's time to vote her out

What You Need To Know

Here’s what happened around the city for the week of March 6, 2023:

- Silicon Valley Bank collapses, thousands of startups affected

- Supervisor Connie Chan fought police funding, it's time to vote her out

- Hundreds of housing units for the homeless are sitting empty. Why can’t S.F. fill them?

- Opinion: Put Algebra 1 back in eighth grade

Silicon Valley Bank collapses, thousands of startups impacted

It’s the largest bank failure since the global financial crisis, and it happened right in our back yard. To oversimplify, Silicon Valley Bank lost a lot of money in hold-to-maturity bad bets, they catastrophically screwed up their corporate comms, and ultimately suffered a bank run and became insolvent. On Friday morning the FDIC closed the bank and will start liquidating assets to pay back depositors.

It’s worth noting that Silicon Valley Bank has been a reliable and responsible partner to tens of thousands of small businesses over the past 30+ years. This collapse didn’t happen because of irresponsible tech execs — it really dates to one particularly bad decision that SVB made in 2021 when it bought up about $100 billion in hold-to-maturity securities that yielded about 1.5%. This was fine (and not even that risky!)… at least until the recent run-up of interest rates which caused these securities to push SVB’s balance sheet into the red.

But the real story isn’t SVB failing. It’s that tens of thousands of startups and small businesses, employing hundreds of thousands of regular people, will go bankrupt overnight if the Federal government doesn’t act immediately. All of these people will be out of jobs and a generation of entrepreneurs will be wiped out through no fault of their own. The White House MUST step in to stop this bank collapse from affecting the entire economy. It’s not fair to the innocent workers who did nothing wrong.

Garry Tan, the CEO of startup accelerator Y Combinator, calls this an “extinction level event” for startups.

If the FDIC and other government regulators don’t move fast enough, thousands of startups will be wiped out.

Silicon Valley bank was uniquely situated to be in a bad regulatory position due to the structure of its business. According to Marc Rubinstein, “At the end of 2022, [Silicon Valley Bank] had 37,466 deposit customers, each holding in excess of $250,000 per account.”

“In aggregate those customers,” Rubinstein continues, “…account for $157 billion of Silicon Valley Bank’s deposit base, holding an average of $4.2 million on account each. […] Out of its total $173 billion deposits at end 2022, $152 billion are uninsured.”

It may seem odd that so many of its customer held so much more than the FDIC insured $250,000 limit, but it’s because those customers were startups and small businesses holding investor funds. While large corporations hold diversified assets across several banks which insulate them from any individual bank failing, startups typically only have cash, and in the Bay Area most of those starts banked with Silicon Valley Bank.

Our hearts go out to the tens of thousands of people affected by this bank collapse. We trust the FDIC and federal regulators will make them whole and avoid a startup apocalypse. It’s a great reminder of the importance of government regulation and the need to update the regulations to reflect the changing risk environment.

Silicon Valley Bank was never subjected to the Federal Reserve’s Liquidity Coverage Ratio requirement – even as the 16th largest bank in America, it was deemed too small.

— Marc Rubinstein

If you’ve been affected by the collapse, the FDIC instructs you to call 1-866-799-0959 to register your balance for eventual payback via liquidation of the bank’s assets.

If you need to make payroll, emergency bridge loans are being offered by Brex, and we’ve hear unconfirmed rumors Stripe is offering the same.

For deeper coverage, we recommend the always excellent Matt Levine at Bloomberg.

Supervisor Connie Chan fought police funding, it's time to vote her out

Last week Connie Chan sent a clear message: she does not care about public safety. She blocked the “supplemental police budget” which would ensure that our officers get paid for their work, the number of officers on patrol doesn’t suddenly decrease precipitously, and the police academy stays open.

But the good news is that we asked all of you to fight for this and you all delivered! She finally buckled to public pressure and grudgingly introduced the funding measure for a vote. But she didn’t do it in time to keep the police academy open.

So now we’re sending an even stronger message: it’s time to Clear Out Connie. We must elect someone who wants to build housing, arrest fentanyl dealers, and fund the police.

Hundreds of housing units for the homeless are sitting empty. Why can’t S.F. fill them?

Over 900 units of homeless housing are vacant, even when there is a growing list of 1,600 people ready to move in. Not only are these units vacant, they won’t even be filled soon: it takes 150 days to move a homeless person into a unit, on average.

As of the end of February, the city reported 912 units were sitting vacant, approximately 10% of its total stock. That’s far more vacancies than the city is comfortable with. City officials say their goal is to have a 7% vacancy rate, to accommodate people transferring between rooms and buildings.

— SF Chronicle

Given the severity of our homelessness crisis, we cannot afford to have bureaucracy, red tape, and inefficiency prevent people from coming in from the cold and getting the help they need. The city needs to figure out what is going wrong, and fix the problem ASAP.

Opinion: Put Algebra 1 back in eighth grade

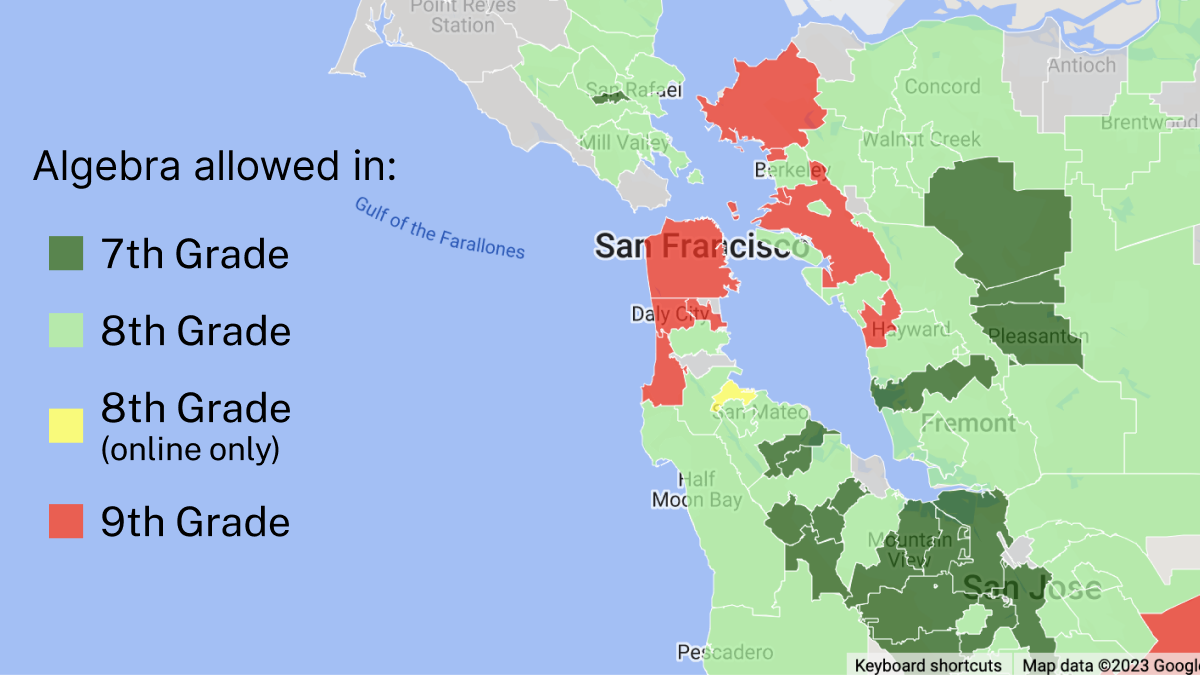

An op-ed in the SF Examiner makes the case for legalizing teaching algebra in 8th grade again.

In 2014, SFUSD denied access to algebra 1 for all eighth graders, regardless of their preparation and motivation, justifying this with the word “equity.” SFUSD subsequently claimed success, but inquiring community members were denied access to supporting data. Obtaining data through public records requests, the district’s success claims were exposed to be grossly misrepresented.

GrowSF strongly believes that kids in San Francisco should be given the opportunity to take algebra and advanced classes, and that we must not respond to unequal outcomes by lowering the bar for everyone. We dream of a future where math is legal everywhere.

New Liberal Action Summit

GrowSF is cohosting a policy conference with our friends at the Center for New Liberalism (CNL) on March 31 at the SPUR Urban Center in SoMa.

The conference, NLAS West, will be the first in a series of regional conferences organized by CNL to discuss a fresh, innovative agenda for the Democratic Party’s future.

NLAS West will feature elected Democratic leaders from the region, activists, policy experts, and political analysts as well as business and civic leaders. The discussion will center on issues of local, regional, and national significance – driving down housing costs, managing fiscal issues in an era of unprecedented inflation, assuring public safety, reinventing public education, modernizing America’s outdated immigration laws, exploring the future of Section 230, and discussing the nation’s bioscience innovation ecosystem.

We invite you to join us and over 100 pragmatic liberals in San Francisco later this month! RSVP here.

Celebrate San Francisco

There’s a lot to love about our city. Here’s what makes it great:

“Muni Raised Me” art exhibit celebrates Muni at the SOMArts Cultural Center

WHEN: Now through April 9

WHERE: SOMArts Cultural Center

The "Muni Raised Me" art exhibit at the SOMArts Cultural Center celebrates the city's working class and their connections to public transit. The exhibit features the work of 13 artists who share their stories about how Muni played an important role in their lives.

"It gave me a freedom that I feel is unique to growing up in the city," said Sasha Vu, co-curator of the exhibit.

— KTVU

The centerpiece of the exhibit is a bus donated by SFMTA, which features an altar paying homage to icons such as Maya Angelou, San Francisco's first African American female streetcar conductor.

The exhibit runs until April 9 and admission is free.

Chris Larsen pledging $2M to SF small businesses

After donating $1.7 million last year, Chris Larsen is back again with another $2 million in grants for struggling retail districts in the city. We admire Chris’s dedication to our city.

If you’re part of a merchant’s association, community group, or nonprofit, you can apply today. See this PDF for instructions.

Love the GrowSF Report? Share it

Help GrowSF grow! Share our newsletter with your friends. The bigger we are, the better San Francisco will be.

Topical Tweets

Yes, there is good stuff on Twitter. Here’s some of it: